A self-employed person may choose to contribute on a monthly or yearly basis and a trustee will provide a self-employed person the Definition of Relevant Income for Self-Employed Person for the declaration of relevant income in so as to determinate the amount of contribution and the payment method in next financial year. The self-employed person should inform the trustee of his/her election at least 30 days before the end of each financial year of the scheme.

If the Scheme member ceases to be self-employed or becomes an employee, the Scheme member needs to inform the trustee and submit the termination notice. He/She may elect to retain the accrued benefits in the existing scheme or transfer the accrued benefits to the scheme in which the new employer is participating. Before the transfer takes place, the Scheme member needs to fill in an election form and submit it to the new employer or his/her trustee.

There are four choices in the Definition of Relevant Income for Self-Employed Person to select. If the self-employed person receives the most recent notice of assessment issued by the Commissioner of Inland Revenue, he/she should use “assessable profits” as the relevant income for mandatory contribution purposes and submit the notice of assessment and the Definition of Relevant Income for Self-Employed Person to us. (e.g.: self-employed person should submit the notice of assessment of 2002-2003 for contributions to be made in 2004). If the self-employed person does not produce evidence of his/her relevant income, he/she may:

i. make mandatory contributions based on the maximum level of relevant income and he/she will not be required to provide evidence of relevant income.

ii. declare his/her relevant income as an amount equal to his/her assessable profits for the preceding year of assessment calculated in accordance with Part IV of the Inland Revenue Ordinance under the following three circumstances:

(1) The issue date of the most recent notice of assessment is more than two years from the date on which the notice is presented as evidence of relevant income; or

(2) The latest tax assessment is objected by the self-employed person or is under appeal; or

(3) The evidence produced by the self-employed person to the trustee of the MPF scheme concerned in relation to his/her relevant income does not consist of, or include, his/her most recent notice of assessment.

iii. take the prevailing basic allowance within the meaning of Section 28 of the Inland Revenue Ordinance (Cap 112) as his/her relevant income if the self-employed person satisfies the trustee of the scheme concerned that he/she is unable to provide evidence of relevant income.

The minimum level of the relevant income for MPF contributions was revised from HK$6,500 to HK$7,100, effective on 1 November 2013. As a result of the amendment, for contribution periods starting on or after 1 November 2013, employees with a monthly relevant income less than HK$7,100 will not be required to make their part of contribution, but their employers will have to continue making the employer’s part of contribution. Self-employed persons with relevant income less than HK$7,100 monthly or HK$85,200 yearly do not have to make contributions. Please note that if you are not required to make mandatory contributions as an employee or self-employed person by reason of this amendment, you may still choose to make voluntary contributions.

For contribution periods commencing on or after 1 June 2014, the maximum level of the relevant income for MPF contributions was amended from HK$25,000 to HK$30,000 monthly and from HK$300,000 to HK$360,000 yearly. As a result of the amendment, the maximum contributions will be adjusted from HK$1,250 to HK$1,500 monthly or from HK$15,000 to HK$18,000 yearly accordingly.

After submitting the application form with all supporting documents, an employer will receive a Notice of Participation within 30 days. We will report employer’s participation details to MPFA.

Yes. Mandatory contributions to be paid to an employee for a certain contribution period are based on the income of the employee during that period. If the income of the employee fluctuates between different contribution periods, then the mandatory contributions will fluctuate correspondingly.

Under the Mandatory Provident Fund Schemes Ordinance (“MPFSO”), it is the employer's responsibility to ensure the calculations of the income and contributions of an employee are accurate.

Yes. Under the MPFA’s Guidelines, relevant income includes wages, salary, leave pay, fee, commission, bonus, gratuity, perquisite or allowance, paid by an employer directly or indirectly to an employee under a contract.

According to the MPFSO, the employer is required to provide a monthly pay-record to each employee within seven working days after the mandatory contribution is made. Information in the pay-record should include the employee's relevant income, the amount of contributions made and the date the contributions were paid to the scheme.

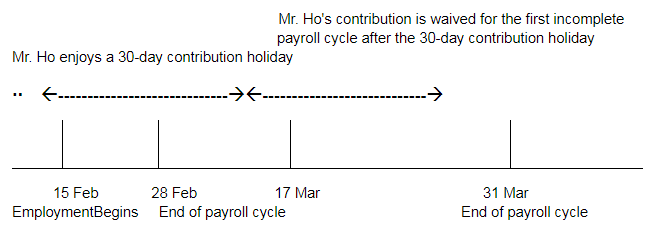

For NEW employees with monthly or more-frequent payroll cycles, e.g., weekly or bi-monthly, the employee’s contribution for the first incomplete payroll cycle immediately following the 30-day contribution holiday will be waived. Employer’s contributions will continue to start from the first day of the employment.

Example: Mr. Ho begins his employment on 15 Feb 2003 with a monthly payroll cycle. Mr. Ho can enjoy a 30-day contribution holiday (i.e., from Feb 15 to Mar 16) and he does not need to make any contribution for the first incomplete payroll cycle (i.e., Mar 17 to Mar 31) immediately following the 30-day contribution holiday. Hence, Mr. Ho starts his contribution on 01 April 2003.

Yes. An employer has the right to switch to another MPF scheme and transfer the accrued benefits of its employees into that scheme. To start the transfer process, the employer should simply provide a written notice to the trustee of the new scheme. Upon receipt of the application, the new trustee will complete the transfer from the existing trustee.

When an employee ceases employment, the employer must give a written notice to the trustee of the scheme concerned no later than the 10th day after the month in which the employee concerned ceases employment. The employer may use the remittance statement to inform the trustee of the employee's cessation of employment and the date of cessation.

According to the MPFSO, an employer must submit the contributions to the trustee within 10 days after the end of the contribution period. If an employer cannot make the contribution on time, a surcharge will be incurred. The following is the calculation of the surcharge:

Surcharge = Total Contribution (Employer + Employee) X 5%

When handling MPF contributions, you should be mindful of the misconceptions to avoid your payment being considered late or default.

The minimum level of the relevant income for MPF contributions was revised from HK$6,500 to HK$7,100, effective on 1 November 2013. As a result of the amendment, for contribution periods starting on or after 1 November 2013, employees with a monthly relevant income less than HK$7,100 will not be required to make their part of contribution, but their employers will have to continue making the employer’s part of contribution. Self-employed persons with relevant income less than HK$7,100 monthly or HK$85,200 yearly do not have to make contributions. Please note that if you are not required to make mandatory contributions as an employee or self-employed person by reason of this amendment, you may still choose to make voluntary contributions.

For contribution periods commencing on or after 1 June 2014, the maximum level of the relevant income for MPF contributions of monthly paid regular employees and their employers was amended from HK$25,000 to HK$30,000. As a result of the amendment, the maximum contributions will be adjusted from $1,250 to $1,500 monthly accordingly.

An employer is bound by the Employment Ordinance to pay SP/LSP to an employee where applicable. After paying the SP/LSP, you can apply to your scheme trustee to withdraw the relevant amount from the accrued benefits derived from the mandatory contributions (and voluntary contributions, if any) to offset the SP/LSP. The SP/LSP will be firstly offset by the accrued benefits derived from the vested portion of employer’s voluntary contribution, if any, followed by the accrued benefits derived from the employer’s mandatory contribution.

The Scheme member can only withdraw the accrued benefits under one of the following conditions:

i. Has attained the retirement age of 65*;

ii. Has attained the early retirement of 60*;

iii. Total incapacity;

iv. Death;

v. Permanent Departure from Hong Kong;

vi. Small Balance Account (if the MPF account balance is less than HK$5,000 and no MPF contributions were made in the past 12 months)

vii. Terminal illness (withdrawal of the accrued benefits will be restricted to mandatory contribution only)

* Withdrawing the accrued benefits by instalments is only applicable for the condition i and ii

If the appointment of the director is under an employment contract who receives remuneration as an employee, he/she is covered by the MPF scheme. On the other hand, if the director is not the employee and only receives director’s fees as an office holder, he/she does not have to be enrolled in an MPF scheme.

After we have received the Member Enrolment Form, the Scheme member will be sent his/her Notice of Participation, Login User ID and Password for Internet Enquiry System which will help the Scheme member to check details of his/her contribution and asset balance etc. Moreover, each Scheme member will receive an Annual Benefit Statement and Fund Fact Sheet within 3 months after the end of each financial year.

The Scheme imposes no restrictions on constituent fund switching. Scheme members may adjust the investment porfolio at any time. Moreover, Scheme members can perform constituent fund switching through our Internet Enquiry System or by completing the Fund Swiching Form. No administration charge is incurred by the constituent fund-switching process.

The Scheme member can log on to Internet Enquiry System to check the asset balance, contribution record and etc. by using his/her Login User ID and Password. Besides, the Scheme member can check the asset balance, contribution record and etc via our hotline or customer service center.

The Scheme members should complete a Fund Transfer Form and submit to the new scheme trustee. In order to avoid any delay in the fund transfer process, please enter the correct scheme numbers for both the original and the new trustees with the correct signature on the form.

The previous scheme trustee is required to ensure that the accrued benefits are properly transferred within 30 days after receiving the transfer request and will issue a transfer statement stating the particulars of the transfer. Trustee of the new scheme will also send a confirmation stating the amount received from the previous scheme.

If the Scheme member has attained the age of 65, he or she can submit a completed Claim Form for Payment of Accrued Benefits together with a copy of his/her identity card to MPF Department. If all information is correct, the accrued benefits can be arranged to be paid to the Scheme member within 30 days.

The Scheme member may defer the withdrawal of accrued benefits and wait until the recovery of the economy.

The minimum level of the relevant income for MPF contributions was revised from HK$6,500 to HK$7,100, effective on 1 November 2013. As a result of the amendment, for contribution periods starting on or after 1 November 2013, employees with a monthly relevant income less than HK$7,100 will not be required to make their part of contribution, but their employers will have to continue making the employer’s part of contribution. Self-employed persons with relevant income less than HK$7,100 monthly or HK$85,200 yearly do not have to make contributions. Please note that if you are not required to make mandatory contributions as an employee or self-employed person by reason of this amendment, you may still choose to make voluntary contributions.

For contribution periods commencing on or after 1 June 2014, the maximum level of the relevant income for MPF contributions of monthly paid regular employees and their employers was amended from HK$25,000 to HK$30,000. As a result of the amendment, the maximum contributions will be adjusted from $1,250 to $1,500 monthly accordingly.